Rising tides lift all boats, and the economy of Bangladesh is no exception. “Fortune favors the bold” might be the perfect motto for Bangladesh today. Being one of the most rapidly growing nations in South Asia and standing at the verge of an economic renaissance- the country is sowing its seeds of progress.

Bangladesh has displayed excellent economic strength, tackling global challenges to maintain steady growth. This article dives deep into the economic indicators and navigates the opportunities and challenges for some selected industries like Ready-Made garments (RMG), Financial Services, E-commerce, Healthcare, Tourism, etc. Navigating this requires forward-planning and data-driven decision-making, and Akij Consulting Ltd. is dedicated to empowering the Bangladeshi business landscape with the insights and guidance needed to thrive in this revolutionary time.

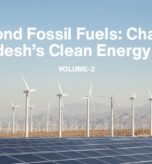

With GDP ascending from US$ 37.9 billion in 1995 to 450.5 billion in 2024 and remittances facing a record high of almost US$ 25 billion in 2024, the nation is proving itself to be an economic powerhouse. For industries like RMG, Financial Services, Retail, Healthcare, and Tourism, these trends show genuine potential.

Economic Conspectus

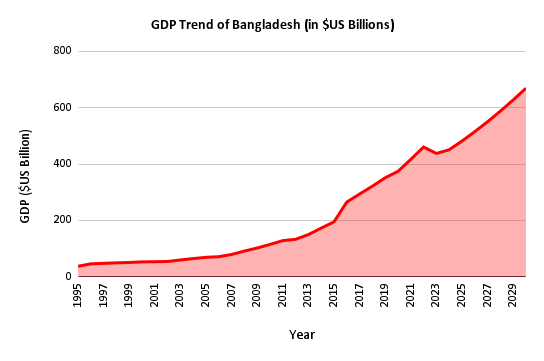

- GDP and GDP Growth (Nominal): GDP growth reached its peak in the years 2018 and 2019 with an annual growth rate of 7.32% and 7.88, respectively. Later, the COVID-19 pandemic hit and caused the GDP growth to fall to 3.45% in 2020, making it the lowest rate in the last 30 years. But currently, Bangladesh has gained its momentum back and is expected to cross 7.5% by 2026. The nominal GDP is expected to reach US$ 700 billion by 2030.

Fig.1 GDP Trend of Bangladesh (in US$ Billions)

Fig.2 Annual GDP Growth (%) of Bangladesh

These metrics are crucial for the manufacturing industry (RMG, Electronics, FMCG, etc), financial services (banking, insurance, investment), retail and consumer goods industry, and tourism industry. Financial institutions study the GDP data to evaluate credit risks. Higher GDP means more business activities and a stronger stock market, therefore, greater demand for loans and insurance. GDP growth has a positive correlation with industrial manufacturing output and consumer buying. Sectors like RMG, electronics, and FMCG align production planning based on market demand to avoid supply shortages or overproduction. Higher GDP growth results in increased demand.

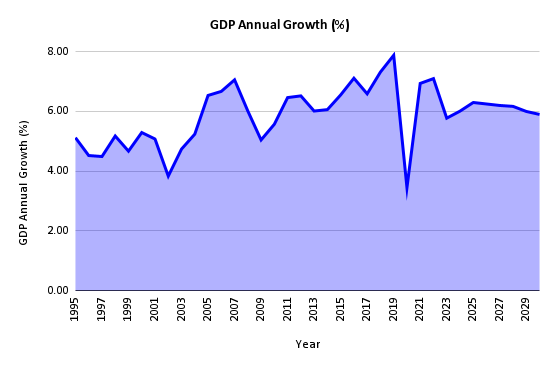

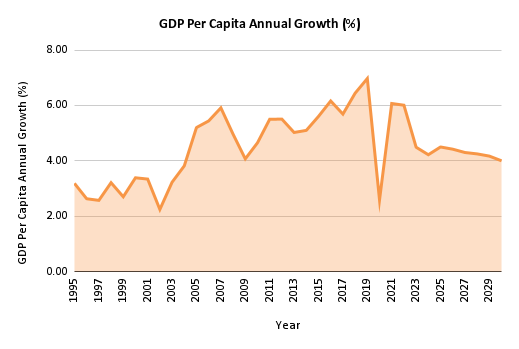

- GDP Per Capita and its Annual Growth (PPP): The GDP per capita currently stands at US$ 2770, the highest ever for Bangladesh, but in recent times, it has had a lot of fluctuations. GDP per capita momentarily increased in the last 30 years except for 2023, but the annual growth rate suffered from extreme fluctuations at different times. Bangladesh saw the highest growth in GDP per capita just before the coronavirus phase, with an average of 6.2%, but in 2020, it faced one of the lowest growths in history: a depressing 2.59%. Post-covid, the growth increased to over 6%, just to fall below 4.5% in 2023, with an average growth of 5.3%.

Fig.3 GDP Per Capita (in US$) of Bangladesh

Fig.4 Annual Growth Rate (%) of GDP Per Capita in Bangladesh

These indicators are important for industries like retail and consumer goods, healthcare, tourism, and real estate. GDP per capita indicates the household disposable income. Retail and consumer goods businesses study the data to introduce newer product lines, pricing strategies, expansion to newer areas, etc. An increased GDP per capita growth signals the healthcare industries to invest more in private hospitals and medical services, as more people can then afford private health services. For the tourism and real estate sectors, the case is similar; they can assess GDP per capita and expand more into luxurious or semi-luxurious residential places and tourism experiences.

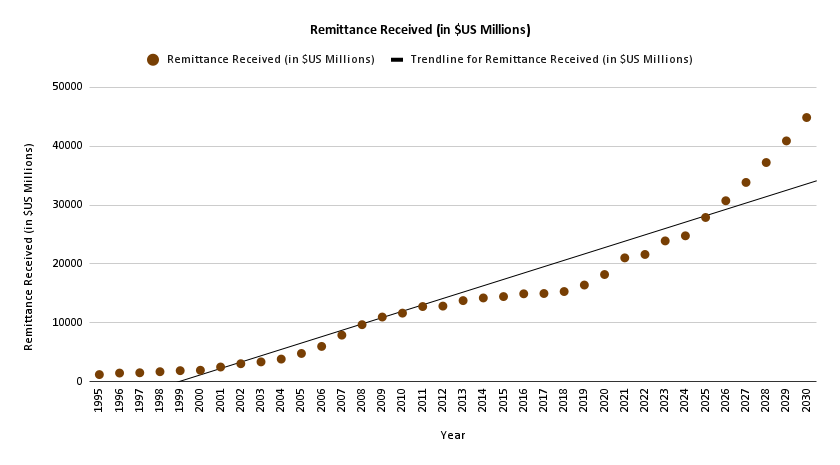

- Wage Earner’s Remittance: For the last 3 decades, the amount of remittance received from foreign wage earners has increased steadily, showing a positive trend. In particular, there has been a 35% increase in remittance earned since the COVID-19 pandemic between 2020 and 2024—a staggering increase from US$ 18 billion to almost US$ 25 billion. This can imply that there may be a rise in demand and services in the next few years.

Fig 5 Wage Earner’s Remittance Inflow (in US$ Millions) in Bangladesh

Remittance inflows play a prominent role in Bangladesh’s economy and contribute drastically to household incomes and consumption. Financial services, real estate, agriculture, and Telecommunication industries rely on remittance data. Banks and NBFIs strictly inspect remittance inflows as they handle the transfer of funds. In recent years, Mobile Financial Services (MFS) like Bkash and Rocket have gained mass popularity for remittance-related transactions, which in return motivated the telecommunication industry to invest and expand more, particularly in remote areas, to serve the mass population. Agricultural workers use money received from remittance to buy capital like tractors and irrigation pumps- improving the agricultural landscape. A substantial portion of remittance is also spent on buying houses, accelerating the real estate industry.

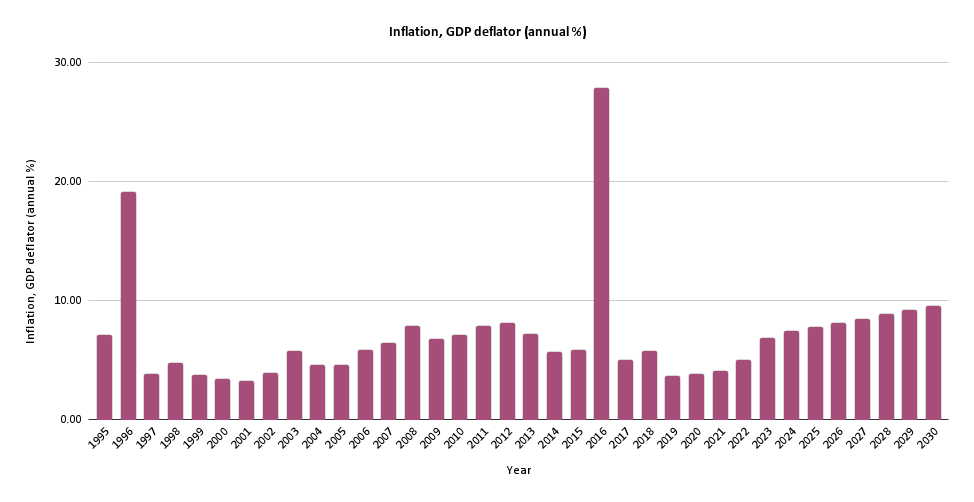

- Inflation, measured by GDP Deflator: Inflation, measured by GDP Deflator (Annual %) “is the measure of inflation in the prices of goods and services produced within a country including exported goods” (Investopedia). Inflation, GDP Deflator fluctuated less over the last 20 years, with a huge spike in 2016, hitting 27.85% due to the change of base year. But, in recent years, there has been a sequential-increasing trend of inflation rising with a 6.9% inflation, GDP deflator in 2023. This indicates a moderate inflationary pressure relative to other developing nations, and businesses must endorse cost-optimization tactics while using the growing purchasing power to its maximum advantage.

Fig.6 Inflation, Measured by GDP Deflator (Annual %) in Bangladesh

This metric matters for all existing industries and businesses. Inflation, measured by the GDP Deflator, provides insights into the price level, cost structures, real growth of the economy, macroeconomic stability, and consumer behavior. High inflation reduces the value of savings, reducing saving incentives and increasing interest rates, making borrowing very expensive. Industries, from RMG to agriculture to financial services and IT, make business decisions depending on inflation values. For instance, the transport and logistics sector would keep an eye on inflation data to foresee fuel, vehicle maintenance, and labor costs. The pharmaceutical industry depends on imported raw materials, and mounting inflation would mean higher import costs, thus forcing them to toggle to cost-effective substitutions or increase prices for their products.

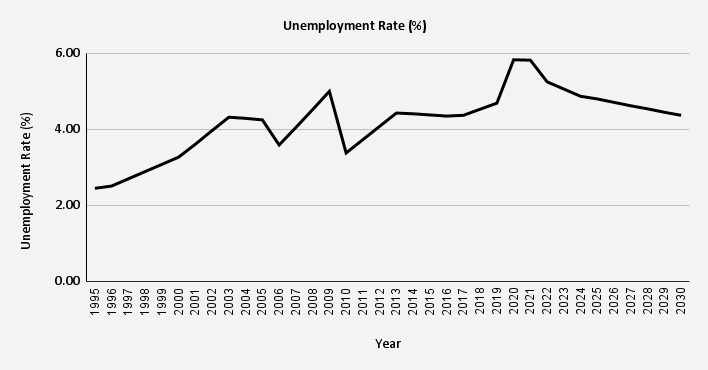

- Unemployment: The Unemployment rate in Bangladesh has been increasing continuously since 1995 till date, with the highest-ever rate of 5.83% during the 2020-2021 phase and falling back slightly to 4.87% in 2024. The average unemployment rate has been 5.37% since Covid-19 has struck, indicating a persistent unemployment problem.

Fig. 7: Unemployment Rate in Bangladesh

The unemployment rate is a key player in the economy, which reflects the labor market conditions. Similar to inflation, the unemployment rate is also a concern for every existing industry. For financial services, banks adjust loan approval criteria, and insurance firms and investors modify their steps based on the unemployment situation. Retailers introduce budget-friendly products and slash high-end product offerings during high unemployment— for example, Shwapno’s beef-potato combo. The manufacturing and real estate sector observes the unemployment rate to gauge worker availability and wage pressures, helping them decide when to hire more to boost their investments. A higher unemployment rate would mean an excess supply of labor and lower wage rates; therefore, hiring in such a situation would help minimize costs for businesses like RMG and construction.

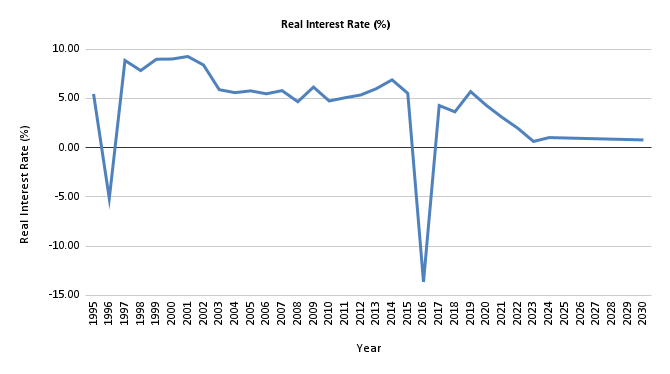

- Real Interest Rate: The real interest rate is a very crucial indicator for businesses in an economy as it reflects the true cost of borrowing or the real return on savings. Businesses need to understand how this affects their operations. High real rates might discourage borrowing because it’s more expensive. There is no particular trend for the real interest rate in the past 3 decades as it heavily fluctuates from time to time. In 1996 and 2016, the real interest rates were negative at -5.16 % and -13.64 %, respectively, due to the change in the base year. The real interest rate was highest during the 2000-2001 phase at 9.26%, and in 2023, it was 0.63%.

Fig.8 Real Interest Rate of Bangladesh

The real interest rate is a major consideration for almost every industry as it affects borrowing, saving, and investing decisions. Financial services, SMEs, manufacturing, and real estate are some notable sectors that rely on the real interest rate. Financial institutions rigorously track the real interest rates because they lend money to borrowers. A high rate would mean less demand for loans, as borrowing is then expensive. SMEs are a vital part of Bangladesh’s economy, but they are contingent mostly on loan incentives; therefore, the real interest is fundamental for them to expand and conduct entrepreneurial activities. The manufacturing and real estate sectors take loans to buy capital like raw materials and machinery, for which, again, real interest rates matter.

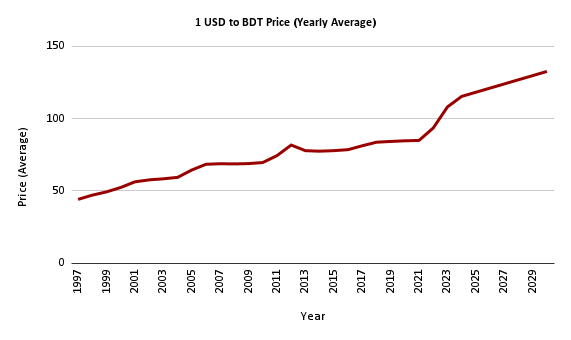

- Exchange Rate: The exchange rate is a very important factor for businesses in Bangladesh as it is heavily reliant on imports. The volatility of the exchange rate has a direct impact on many sectors of Bangladesh. The Bangladeshi Taka (BDT) has been experiencing depreciation pressures for a long time, which is making imports more expensive, weakening economic growth, and resulting in rising inflation. In the last ten years, BDT depreciated by almost 48% against USD, with the average price in 2015 being 77.78 BDT and 115.33 BDT in 2025.

Fig.9 Exchange Rate against USD of BDT

Exchange rates (USD to BDT) are primitive for industries engaged in international trade, FDI, and remittance inflows. Export-oriented sectors like RMG, leather, and jute and import-oriented sectors like electronics, automobiles, and oil are centered upon exchange rate values. A higher exchange rate (weaker BDT) means exports are cheaper and more competitive in the international market, but import costs will be substantial, making it very costly to buy raw materials or necessary equipment.

By 2030, businesses in Bangladesh are braced to evolve immensely, driven by robust economic advancements and market dynamics. A predicted nominal GDP of US$ 700 billion and a sturdy GDP growth running over 7.5% signals a prosperous and thriving economy. Key industries like RMG, financial services, manufacturing, retail, healthcare, real estate, tourism, etc, will have the chance to cruise in an environment filled with both opportunities and challenges. The data highlights a dynamic transformation across these industries, catalyzed by rising GDP per capita, record-high remittance inflows of US$ 25 billion (approximated as of 2024), and incrementing purchasing power and consumer demand regardless of moderate inflationary pressures and a depreciating value of BDT.

In such a potential future, companies should employ more data-driven strategies, invest in next-generation technologies like artificial intelligence and machine learning, and abide by sustainable business practices to maintain competitiveness and penetrate deeper into the international market.

Export-oriented sectors like RMG can capitalize on the weaker exchange rate to boost exports. While, financial institutions and SMEs will traverse the real interest rate fluctuations to streamline borrowing and investment, and healthcare and tourism will serve a wealthier populace. Supported by firms like Akij Consulting Ltd, this marination of resilience and innovation orientates the business landscape of Bangladesh as a powerhouse of opportunity— balancing global integration with domestic growth.