Overview

April 2025 began with a fatal blow for the entire world as the US president, Donald Trump, had imposed sweeping tariffs in order to balance the country’s trade deficit, causing a distorted global supply chain management. This protectionist policy resulted in increased costs, delayed shipments, stock market fallout, and international trade war tensions. These actions have sparked huge concern within the international bodies, economists, and businesses一 raising questions about the possible ramifications for the health of the global economy. A tariff, also known as an import duty, is a type of tax put on imported goods by a government to protect the domestic industry. Such taxing increases the price of imported goods and creates incentives for domestic production, but when imposed on a vast segment of international trade, the outcome is unsettling. Mr. Trump put a minimum 10% ‘reciprocal’ tariff on all countries’ imports, with an even higher percentage on many selected countries.

Reciprocal tariffs for different countries unveiled by Donald Trump on 2nd April, a day he named ‘Liberation Day’.

China has been hit hardest, with a massive 145% tariff rate, as of 9th April, after several rounds of retaliation between the countries starting from 2nd April. The countries that come next with being ‘hit the hardest’ with the reciprocal tariffs are Cambodia (49%), Laos (48%), Madagascar (47%), Vietnam (46%), Sri Lanka (44%), and Myanmar (44%). These countries had previously imposed the highest tax on US imports; thus, currently facing the highest reciprocal tariffs. On the other side, Bangladesh had been slapped with a 37% import duty as opposed to its 74% on the US; this implies a minimum of 10% increase in import prices. In short, the developing nations had been hit the hardest, albeit the developed nations were not spared, except Canada and Mexico. (*As of 9th April, Trump paused all reciprocal tariffs for 90 days, but the 10% universal baseline tariffs are still in effect, except for China; more details are provided later in the writing)

Impact of Global Trade

Mr. Trump imposed other forms of tariffs on various countries. Such as the 25% import duty on steel and aluminium- mainly affecting Australia, automotive goods- mainly affecting the EU, and on the Venezuelan oil sector. A potential ‘more than 25%’ tax is lurking for the semiconductor and pharmaceutical industries. Such taxing behavior from the Trump administration provoked some nations to throw back a ‘retaliatory’ tariff to the US. China, Canada, and the EU are amongst those who imposed counter-tariffs on the US, with China engaging into a battle of tariffs with the US.

As of 9th April 2025, President Trump has decided to pause the reciprocal tariffs- which seemed almost impossible previously- for all trading partners for 90 days till 9th July (until further changes)- except for China, where he instead increased the amount to 145%, mounting tensions for the US-China trade battle. However, the universal baseline 10% tariffs for all nations are still in effect. Mr. Trump was open to negotiation from the beginning, and a vast number of countries approached him for negotiations. His imposed tariffs were in action for a week before his declaration of pausing. In this one week, the world felt shockwaves over the trading system. The World Trade Organization (WTO) issued a strong warning that the reciprocal tariffs, coupled with other trade barriers, would result in an overall contraction of 1% in global trade volumes. Specific industries suffered from immediate impacts; apparel and automobiles are particularly exposed to trade disputes.

The automotive industry supply chains faced a great amount of uncertainty over the 25% tariffs on vehicles and parts, shaking the manufacturing procedure across the US, Canada, and Mexico. Temporary factory shutdowns and layoffs were the immediate impacts.

The aluminium and steel sector also stood in line for immediate consequences. Facing a 25% tariff, manufacturing and construction industries, reliant on these metal inputs, were burdened with increased costs of production. Agriculture bore a mass repercussion, conspicuously due to the retaliatory steps by a few countries.

The initial tariff announcement caused significant market turmoil, including a bond market collapse and a $6 trillion loss for investors. This economic instability likely pressured Trump to pause the tariffs to stabilize markets and mitigate recession risks, as seen in major stock rallies following the announcement.

What is a bond market and how is this relevant here?

A bond market is a financial marketplace where participants can issue, buy, and sell debt securities, primarily bonds. Bonds are essentially loans where the issuer—such as a government or corporation—borrows money from investors and agrees to repay the principal with interest over a specified period. The bond market plays a critical role in the economy by helping determine interest rates, which influence borrowing costs for governments, businesses, and consumers. It also serves as a key indicator of investor confidence and overall economic health.

The bond market is highly relevant to Trump’s decision to pause reciprocal tariffs because it both reflects and influences economic conditions. When Trump initially announced the tariffs, the bond market experienced a significant negative reaction, including a collapse that raised concerns about U.S. deficits and debt. This market turmoil signaled potential economic instability, such as higher borrowing costs and reduced investor confidence, which could derail economic growth. The pause on tariffs was likely a response to this bond market reaction, as stabilizing it was essential to prevent further economic fallout. Essentially, the bond market acted as a feedback mechanism, highlighting the risks of the tariff policy and prompting Trump to reconsider his approach

The bond market is a vital component of the financial system, influencing interest rates, investor confidence, government debt, and business financing. Its relevance to Trump’s tariff decision lies in its ability to signal economic risks—such as those posed by the initial tariff announcement—prompting a policy adjustment to maintain stability. By impacting borrowing costs and confidence, the bond market shapes the economic environment for both governments and businesses.

The bond market is a vital component of the financial system, influencing interest rates, investor confidence, government debt, and business financing. Its relevance to Trump’s tariff decision lies in its ability to signal economic risks—such as those posed by the initial tariff announcement—prompting a policy adjustment to maintain stability. By impacting borrowing costs and confidence, the bond market shapes the economic environment for both governments and businesses.

The Long View: Potential Ramifications

Going past the immediate turmoil, the long-term economic consequences of Mr. Trump’s tariffs paint a tangled and distressing picture, primarily about the possibility of sustained inflation一 at least, the economic theory suggests so that the increased costs of imports pass on to consumers in the form of higher prices. According to USTR assumptions, a 1% tariff increase raises import prices by 0.25% and reduces demand by 1%. Like so, a 20% average tariff could lead to a 5% price hike and a 20% fall in demand.

Economists and experts believe importers will have difficulty in adapting to the US president’s harsh tariff impositions. Manufacturers will have few places to shift production to avoid Trump’s probable round of tariffs. Companies may opt to pay higher tariffs instead of moving out production, and profit margins will shrink as not all costs can be passed on to the consumers.

“In some cases, it will be more cost-effective for companies to pay the tariffs than relocate their production” – Vidya Mani, University of Virginia associate professor of business administration, during an interview on the school’s website.

Supply chain management, already distorted by the COVID-19 pandemic and the Russia-Ukraine war, is under the threat of further long-term disruptions. Businesses relying on international sourcing were compelled to reassess their strategies, considering options such as diversifying suppliers, nearshoring production, or even reshoring to their home. Such adjustments often involve significant costs and time, potentially leading to prolonged periods of instability and increased prices for both businesses and consumers.

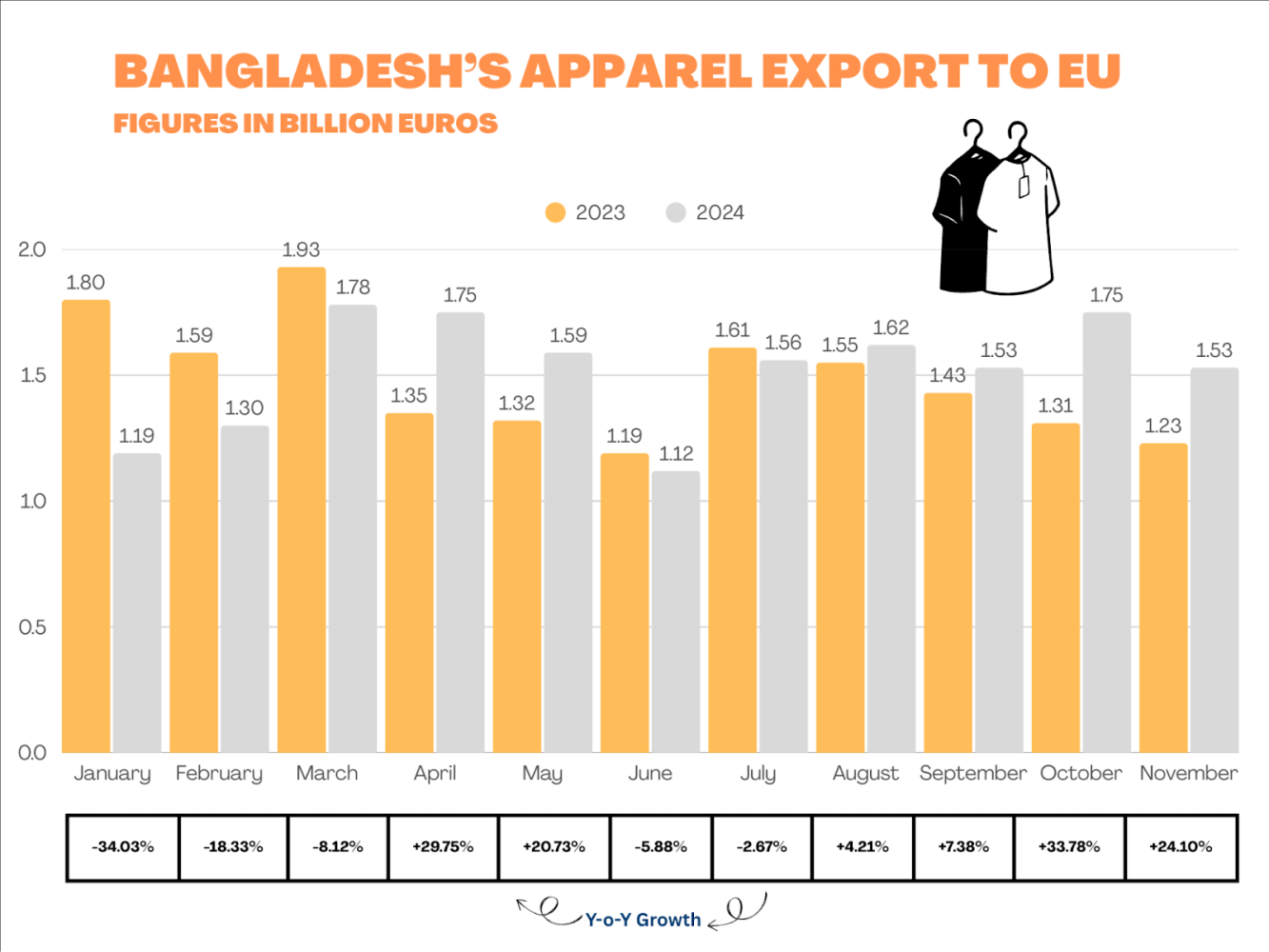

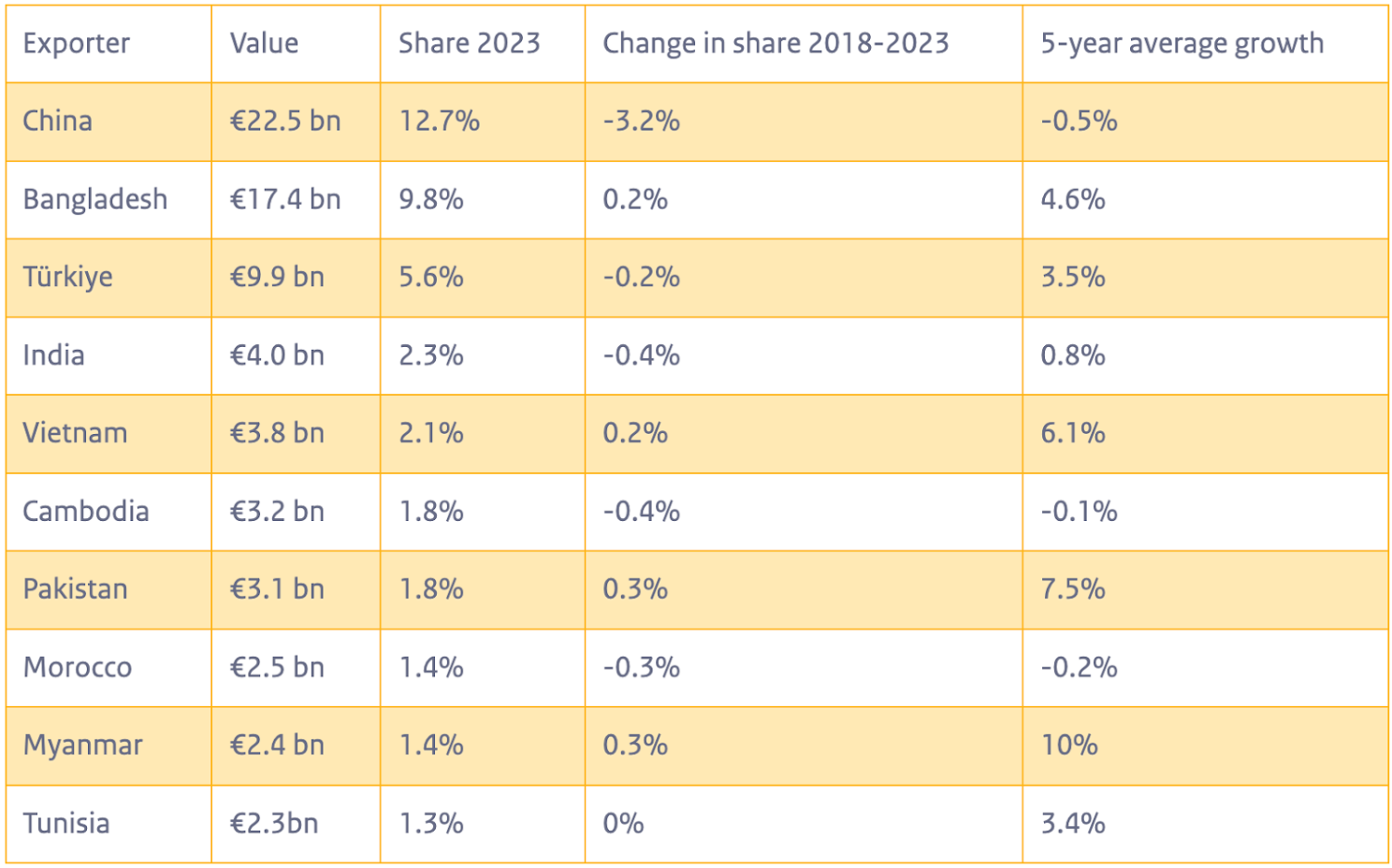

Bangladesh faces a more parlous challenge beyond the US because Chinese exporters may re-shift excess supply to markets like the EU, Japan, and Canada- intensifying competition. Bangladesh holds a 21% share in the apparel market in the EU, and such diversions from China may potentially pull down prices, crumbling competitiveness, and profitability. Moreover, Bangladesh is already facing forex limitations and high inflation, which could worsen macroeconomic vulnerabilities and perplex stabilisation efforts.

Source: Eurostat

Top 10 Extra-EU exporters to EU, 2023 value, share in %, 5-year average annual growth.

To-Do and Policy Implementations for Bangladesh

The trade tension between the US and China may be handy for Bangladesh, as it will provide new opportunities. Economists and exporters of our country believe that the Chinese products will lose their competitive edge in the US market due to mounting tariff rates, forcing American buyers to shift their orders and investments away from China, and Bangladesh needs to grab their attention. To attract American businesses, the government must take abrupt and effective steps to improve the ease of doing business in our nation.

“The trade war between the United States and China will create instability in the global market. In the short term, this may lead to a decline in product demand. However, in the medium and long term, a golden opportunity awaits Bangladesh, as both business and investment are expected to shift away from China. No matter how much China negotiates in the coming days, the additional tariffs in the US market will not be eliminated.”– Speaking to Prothom Alo, MA Razzaque, chairman of the private research organisation Research and Policy Integration for Development (RAPID).

The tariff reciprocity formula used by Trump’s team is not without merit and could be used by many countries in the future. If a country like Bangladesh were to allow American products to enter duty-free, it could later use this formula to negotiate reciprocal benefits—essentially requiring another country, for example, Japan, to purchase a certain volume of Bangladeshi products if they also demand free tariffs. The formula would only come into play once American products start being purchased in significant amounts, and Bangladesh should quickly place orders for American goods—particularly agricultural products like food, cotton, oil, and gas—before prices rise. The US is the largest exporter of agricultural products in the world. The suggestion is to begin with a $1 billion order. Rather than waiting passively, policymakers in Bangladesh should capitalize on this tariff reciprocity approach to secure favorable trade terms with the US.

As per the Bangladesh National Board of Revenue (NBR), the top exports from Bangladesh to the US in fiscal year 2023–24 were: ready-made garments, caps, leather shoes, home textiles, wigs, and leather products. Orders for high-end apparel were previously put in China by the US, but now this trend is shifting, with a portion of this shift potentially moving towards Bangladesh. To secure those investments, we should prioritize specialized garments, synthetic fibers, electronics, footwear, and toys.

References

Boehm, Eric, et al. “Trump’s tariffs: It’s not just the stock market that’s in trouble.” Reason Magazine, 7 April 2025, https://reason.com/2025/04/07/trumps-tariffs-its-not-just-the-stock-market-thats-in-trouble/. Accessed 15 April 2025.

Bond, David E., et al. “President Trump Expands Steel and Aluminum Tariffs to All Countries; Effective March 12, 2025.” White & Case LLP, 17 February 2025, https://www.whitecase.com/insight-alert/president-trump-expands-steel-and-aluminum-tariffs-all-countries-effective-march-12. Accessed 15 April 2025.

Hartleben, Claudia D., et al. “Steel and Aluminum Import Tariffs of 25% to Take Effect March 12; Reciprocal Tariffs Announced | Insights | Greenberg Traurig LLP.” Greenberg Traurig, LLP, 18 February 2025, https://www.gtlaw.com/en/insights/2025/2/steel-and-aluminum-import-tariffs-of-25-to-take-effect-march-12-reciprocal-tariffs-announced. Accessed 15 April 2025.

Karmakar, Shovongkor. “US tariff on Bangladeshi products could have reached 52pc.” The Daily Star, 10 April 2025, https://en.prothomalo.com/business/txq3mgl823.

Karmokar, Shuvonkar. “Bangladesh eyes opportunity as Trump imposes high tariffs on Chinese goods.” Prothom Alo English, 12 April 2025, https://en.prothomalo.com/business/local/8v0a1yw5il. Accessed 15 April 2025.

Lane, Terry. “Trump’s Wide-Ranging Tariffs Could Complicate Supply Chains.” Investopedia, 7 April 2025, https://www.investopedia.com/wide-ranging-tariffs-could-complicate-supply-chains-11709471. Accessed 15 April 2025.

Razzaque, Abdur. “The new trade disorder: US reciprocal tariffs and Bangladesh.” The Daily Star, 4 April 2025, https://www.thedailystar.net/business/news/the-new-trade-disorder-us-reciprocal-tariffs-and-bangladesh-3863406. Accessed 15 April 2025.

Razzaque, Abdur. “The new trade disorder: US reciprocal tariffs and Bangladesh.” The Daily Star, 4 April 2025, https://www.thedailystar.net/business/news/the-new-trade-disorder-us-reciprocal-tariffs-and-bangladesh-3863406. Accessed 15 April 2025.

Staff Correspondent. “What does the US tariff offensive mean for Bangladesh?” The Daily Star, 3 April 2025, https://www.thedailystar.net/business/news/what-does-the-us-tariff-offensive-mean-bangladesh-3862526. Accessed 15 April 2025.

Wikipedia. “Tariffs in the second Trump administration.” Wikipedia, https://en.wikipedia.org/wiki/Tariffs_in_the_second_Trump_administration. Accessed 15 April 2025.

WISEMAN, PAUL. “What to know about the Trump tariffs upending global trade and markets.” AP News, 3 April 2025, https://apnews.com/article/trump-tariffs-economic-impact-trade-markets-3e38352ab5693852bfd9bc8dd2ac2d56. Accessed 15 April 2025.