Revolution of coffee in a Tea-loving country, is there a potential?

“Fika” in Sweden is a cultural tradition of taking a break while working to enjoy a cup of hot coffee often with colleagues; in other words, it is a coffee break in between working. It is seen as a way to improve productivity and well-being. Coffee is not merely a beverage but a mechanism for socializing, connecting, and hanging out. Even during moments of economic downturns and recession, people do not give up coffee, as seen in Greece- portraying business potential.

Employees of a company having a laugh during a coffee break

In a land where tea has reigned supreme for centuries, an unexpected aroma is stirring the air—freshly brewed coffee. This quiet revolution began in 2011 with North End Coffee Roasters, Bangladesh’s first specialty café, founded by Rick and Chris Hubbard. Rick Hubbard partnered with farmers to grow coffee locally, and he found huge potential in Bangladesh to grow and process coffee.

The history of coffee dates back to the 9th century in Ethiopia, where it was first discovered. Later, from the 15th century, coffee farming started in Yemen, and then in the 16th century, it started gaining popularity in the Arabian Peninsula.

Since then, coffee has continuously gained fame among people and has turned out to be the most preferred morning beverage. Brazil is the largest producer of coffee, followed by Vietnam, Colombia, and Indonesia. In Bangladesh, coffee is only grown in Bandarban, Rangamati, and Khagarachori, with experimental cultivation underway in Tangail, Rangpur, and Nilphamari. Rick firmly believes that Bangladeshi-grown coffee can provide the same quality as coffee grown in Central and South American nations. North End is also working collaboratively with USAID, FAO, and NGOs to train the farmers in coffee production.

Once dominated by the Swiss conglomerate giant Nestle, which marketed and exported instant coffee in Bangladesh, the scenario has transformed with other imported coffees, locally grown coffees, and roastery coffee chains. Awake Coffee Roasters, Arabika, Delifrance, Kavazo, Tabaq, Crimson Cup, Beans and Aroma, The Coffee Beans and Tea Leaf, etc., are some of the top names. Demand for coffee (in terms of revenue) is 11 times more than tea in Bangladesh, yet the tea market is 53 times bigger in contrast to coffee- as reported by Prothom Alo. Lately, two local conglomerates: the PRAN-RFL Group and the Abul Khair Group are doing a commendable job in our coffee market, contributing to the popularisation of coffee in Bangladesh.

Photo Collected: Korea Bizwire

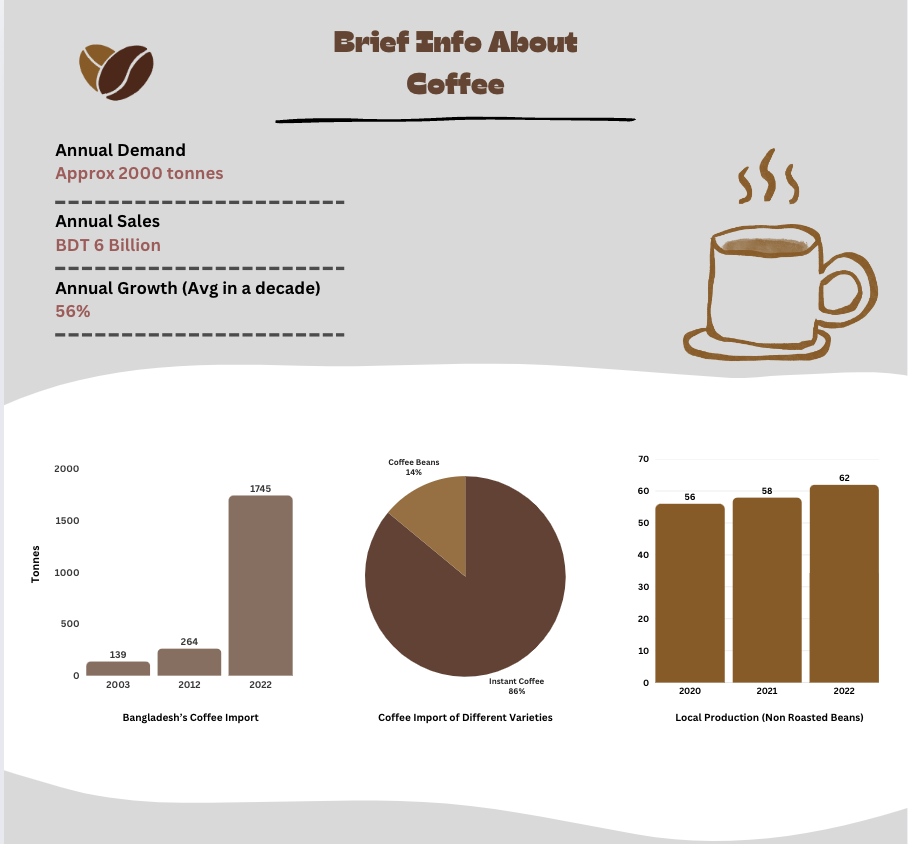

According to 2022 statistics, the local demand for tea is rising by 5% annually, whereas for coffee, it is rising at a rate of 56%. Since the coffee market is growing dramatically, Bangladesh’s top industrial companies are now interested in coffee production— investing in growing it locally and importing it.

“Coffee is the favorite drink of the civilized world.” — Thomas Jefferson, 3rd U.S. President.

With the rapid rise of the Middle and Affluent Class (MAC) population in Bangladesh resulting from a continuous increase in purchasing power, Coffee, which once was like a luxury drink, has now become a common item in people’s lives, specifically among younger consumers. Bangladesh produced around 56 tonnes of coffee in 2020, and an estimated 2000 farmers worked in coffee farming as of 2023. Bangladesh’s coffee market has the potential to grow at a compound annual growth rate (CAGR) of approximately 7.7% over the next five years.

A promising route lingers for the Bangladesh coffee market with opportunities for continuous expansion and innovation to meet mounting consumer demands, despite challenges to combat. This can even result in more foreign investments; for instance, the global coffeehouse and roastery giant and the protagonist in the world of coffee- Starbucks Corporation- might be interested in operating in Bangladesh as their target market is the MAC population. Moreover, the potential of farming high-quality coffee in Bangladesh might interest Starbucks in using our locally grown beans internationally. As a result, employment opportunities will increase in the country, and more business opportunities will develop.

Despite the burgeoning interest, the cost of coffee is a major downside. Coffee is expensive in Bangladesh compared to tea, and the recent crisis in the global coffee industry further drove up the prices. Even with the popularisation of coffee, tea remains deeply sewn in Bangladeshi culture as a conventional choice of hot beverage. Due to this competition, efforts to pierce the market and transfer consumer choices more towards coffee may entail strategic pricing and targeted marketing campaigns to compete successfully against the dominance of tea. For instance, creating public awareness regarding the health benefits of coffee and the right amount of healthy coffee intake. According to Johns Hopkins Medicine, coffee is good for humans for various reasons including less chance of heart failure and stroke and better processing of glucose in our body.

Bangladesh is beholding a transformation in its beverage panorama. The story of coffee in the country is of revolution and unused potential: a journey from a luxury to a mainstream beverage that is becoming irrefutable. The increase in consumer purchasing capability and the preferential change among the younger generation, teamed with industry pioneers have introduced the basis for a robust, data-driven evolution. Additionally, local conglomerates are pitching in, investing in manufacturing and imports to capitalize on the rising demand catalyzed by a burgeoning Middle and Affluent Class (MAC) population and a younger generation embracing coffee as a lifestyle choice. Yet, this journey is not without its barriers. The dominating tea culture and the high cost of coffee in a price-sensitive economy pose major challenges. However, the opportunities offset the obstacles. With a good projected growth over the next five years, strengthened by innovative approaches to local sourcing, the coffee market is poised for sustained development. As Bangladesh’s coffee culture continues to brew, it reflects the power of entrepreneurship, community, and shifting consumer tides. The future is promising—a blend of tradition meeting modernity, where coffee is no longer just a luxury but a symbol of progress.

References

- Kanya, Promila. How a café at Dhaka’s ‘North End’ revolutionised the city’s coffee culture. 14 February 2021. March 2025. <https://www.tbsnews.net/feature/panorama/how-cafe-dhakas-north-end-revolutionised-citys-coffee-culture-201451>.

- Milad, Masud. Coffee market brews strong in Bangladesh. 20 June 2023. March 2025. <https://en.prothomalo.com/business/local/rju1kfhvx2>.

- Ahmed, Shamim and Abdur Razzak Sohel. Energising coffee culture in Bangladesh. 26 June 2022. March 2025. <https://businesspostbd.com/business-connect/energising-coffee-culture-in-bangladesh-2022-06-26>.

- Rahman, Wafiur. World-class coffee from Bangladesh? That is a possibility. 17 January 2021. March 2025. <https://www.dhakatribune.com/business/commerce/235988/world-class-coffee-from-bangladesh-that-is-a>.

- 6W Research. Bangladesh Coffee Market (2025-2031) | Trends, Industry, Companies, Forecast, Growth, Share, Analysis, Value, Size & Revenue. Market Research Report. Dhaka: 6W Research, 2022.

- Bangladesh Monitor. North End country’s largest coffee roaster. 16 September 2021. March 2025. <https://www.bangladeshmonitor.com.bd/hotel-and-restaurant-details/north-end-countrys-largest-coffee-roaster>.

- Johns Hopkins Medicine. 9 Reasons Why (the Right Amount of) Coffee Is Good for You. March 2025. https://www.hopkinsmedicine.org/health/wellness-and-prevention/9-reasons-why-the-right-amount-of-coffee-is-good-for-you

- Reuters. Despite crisis, few Greeks ready to forgo coffee. 4 July 2015. March 2025. https://www.reuters.com/article/business/despite-crisis-few-greeks-ready-to-forgo-coffee-idUSKCN0PE0LM/